blog

Market Report : Automotive Tinting Film Market Size, Share & Trends Analysis Report

- 2024.05.28

- Martin. C

The following contents are from Grand View Research.

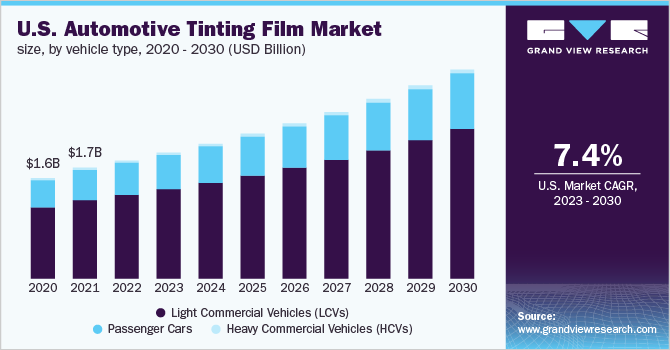

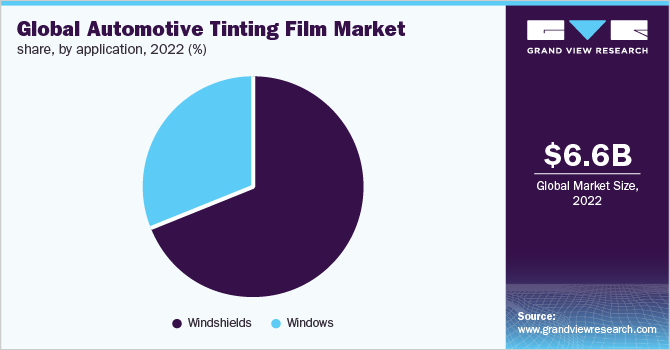

Automotive Tinting Film Market Size, Share & Trends Analysis Report By Vehicle Type (LCVs, HCVs), By Application (Windows, Windshields), By Region (North America, Asia Pacific), And Segment Forecasts, 2023 - 2030

Report ID: GVR-2-68038-018-7Number of Pages: 80Format: Electronic (PDF)

Historical Range: 2019 - 2022Industry: Bulk Chemicals

Report Overview

The global automotive tinting film market size was valued at USD 6.65 billion in 2022 and is anticipated to progress at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The industry is anticipated to be driven by the growing automotive industry globally, particularly in the developing nations of the Asia Pacific, Central America, and South America regions. Consumer propensity for protection of expensive luxury car interiors and personal safety from harmful sun rays are some of the factors that are expected to drive the market over the forecast period. Demand for passenger cars in developing countries has increased on account of rising disposable income, growing working population, and rapid urbanization, which will drive the market further.

The COVID-19 pandemic had a negative impact on the global industry in 2020. Due to the government-imposed shutdown to stop the spread of the virus, vehicle facilities were temporarily shut down. Some plastic feedstock manufacturing has been substantially cut, which has had a significant influence on the global industry. Tinting laws in different countries are expected to negatively impact market growth. Some countries, such as the U.S., have exemptions if passengers or drivers suffer from certain medical conditions, such as sunlight allergies, lupus, photosensitivity, or melanoma. The window tinting ban in India is expected to have a negative impact on regional market growth.

Several manufacturers in the market are undertaking initiatives, such as mergers & acquisitions, and strategies, such as acquiring the division of other competitors, to expand their vehicle type portfolio. Key players are focused on developing new vehicle types, thereby increasing their market penetration. Technological advancements, such as the introduction of bio-based polyester films, combined with rising consumer purchasing power, are expected to drive vehicle demand. Furthermore, rising consumer awareness about the product benefits, combined with the automotive industry's rapid recovery, is expected to boost vehicle demand during the forecast period. Visible Light Transmission (VLT) restrictions are expected to limit the industry's growth.

Window tinting in cars reduces VLT through car windows. Poor visibility can lead to theft or an accident, especially at night. The raw material used to manufacture vehicle type plays an important role in the quality of the window films manufactured. Major players are constantly working on innovative processes for thin coatings and more efficient double and triple-glazing methods for high levels of glare reduction and UV blocking. Global players have a strong distribution network and offer products at the most economical prices. For example, TintFit Window Films Ltd. received the award for Best National Window Film Supply and Installer in 2021.

Vehicle Type Insights

On the basis of vehicle types, the industry has been categorized into passenger cars, Heavy Commercial Vehicles (HCVs), and Light Commercial Vehicles (LCVs). The passenger cars vehicle type segment dominated the global industry in 2022 and accounted for the maximum share of more than 65.68% of the overall revenue. Tinting films are applied to passenger car windows and windscreens to protect from harmful UV rays. Tinting films reduce heat and glare while also protecting against UV rays.

On account of the rising disposable income and changing lifestyles, the sales of passenger cars and LCVs worldwide are expected to increase during the forecast period. This, in turn, is estimated to drive the overall product in the years to come. With constant improvements in transportation and trade around the world, especially in the Asia Pacific region, the demand for LCVs is expected to rise during the forecast period. Window tint films are applied to the windshields of LCVs to reduce glare and block UV rays.

Application Insights

In terms of revenue, the windshields application segment dominated the industry and accounted for the maximum share of more than 69.35% in 2022. Tinting films provide protection from UV rays. The vehicle type reduces glare and ensures the clear vision and safety of the driver. Most automobile manufacturers use tinting films to provide the best driving experience & protection and avoid glare. Harmful sunlight entering the vehicle through the windshield can cause driving discomfort and make long drives difficult.

It helps reduce this effect and makes driving comfortable. The windows application segment is also expected to experience significant growth during the forecast period. Tinting films are used to provide protection against harmful UV rays. The increasing product demand to reduce vehicle interior temperatures, protect interiors from UV rays, and provide a comfortable driving experience for passengers is expected to drive the growth of this segment over the forecast period.

If you want to read a full report, feel free to visit at https://www.grandviewresearch.com/industry-analysis/automotive-tinting-film-market.

Pender

Pender

Rode

Rode

Santana

Santana

Shure X

Shure X

Camo

Camo

Sunset R

Sunset R

Reiney Blue

Reiney Blue

Aura

Aura

Aero Shield 500

Aero Shield 500

Aero Shield 700

Aero Shield 700